Being told you need an SR-22 in Indiana can feel overwhelming, especially if you’re already dealing with a license suspension or recent violation. The good news is that SR-22 is simply a way for the state to confirm you carry the required auto liability coverage—not a lifelong penalty or a completely different type of insurance. In this guide, you’ll learn what SR-22 insurance is, when it’s required, how the filing works in Indiana, what it can cost, and practical steps for staying compliant and reinstating your license.

SR-22 Basics in Indiana: What It Is, Why It’s Required, and How It Works

SR-22 is not a separate insurance policy. It’s a certificate your insurer files with the State of Indiana to prove you maintain at least the minimum liability coverage required by law. This filing shows the state you’re meeting its financial responsibility rules.

When SR-22 Is Typically Required

Indiana may require an SR-22 after serious or repeated violations, such as:

- DUI or reckless driving

- Driving without valid insurance

- License reinstatement after a suspension

- Accumulating multiple moving violations that indicate higher risk

SR-22 itself doesn’t erase past violations or automatically lower your rates. Instead, it confirms that you’re continuously insured while you rebuild a safer driving record.

How SR-22 Works in Indiana

Once you choose an insurer that offers SR-22 filings, your provider submits the certificate to the state on your behalf. This tells the BMV that you have an active auto policy that meets Indiana’s minimum limits.

Most Indiana drivers must keep SR-22 status for about two to three years, depending on the severity of the offense. During this period, continuous coverage is critical:

- If your policy is canceled or lapses, your insurer must notify the state (often by filing an SR-26).

- A lapse can trigger an immediate license suspension and may extend how long you’re required to carry SR-22.

By staying insured without interruption and avoiding new violations, you move closer to the point where the SR-22 requirement can be removed and you can return to standard auto insurance. An independent agency like Torian Insurance can help you compare options, manage costs, and make sure your filing stays active from start to finish.

Debunking Common SR-22 Myths

When faced with SR-22 requirements, many misconceptions can arise. Clearing up these myths helps you make informed decisions and reduces the stress of meeting state guidelines. For a comprehensive overview of the statutory rules, refer to Indiana Code Title 9, which governs motor vehicle laws including permissible penalties and requirements.

Myth: SR-22 Insurance Is a Separate Policy

Reality: SR-22 is simply a certification filed by your insurer indicating that you carry the state’s minimum liability coverage. It’s not a standalone product that replaces or duplicates your auto insurance policy.

Myth: SR-22 Coverage Will Last Forever

Reality: Most SR-22 requirements span two to three years, depending on the violation’s severity. Once you fulfill this period without additional major infractions or coverage lapses, you no longer need to maintain SR-22 status.

Myth: SR-22 Is Only for DUI Offenders

Reality: While common for DUI offenses, SR-22 can also be mandated for repeated moving violations, driving uninsured, or accumulating too many points on your license. It’s a tool the state uses to ensure you maintain valid insurance.

Myth: SR-22 Automatically Causes Unaffordable Insurance

Reality: While insurance rates may rise during the SR-22 period, they are not always prohibitively high. Partnering with an independent agency that compares multiple providers can help you find competitive options to manage your risk profile more effectively.

Myth: Switching Insurance Companies Invalidates Your SR-22

Reality: You can switch providers if you need better rates or coverage. However, your new insurer must file an SR-22 on your behalf before you cancel the existing policy to avoid coverage gaps. Continuous coverage is key to meeting SR-22 obligations.

Understanding these myths enables you to navigate the SR-22 process more confidently. With the right guidance, SR-22 insurance doesn’t have to be complicated or overwhelming.

Types of SR-22 Insurance Coverage

Non-Owner SR-22 Insurance

If you do not own a car but occasionally rent or borrow one, a Non-Owner SR-22 policy offers liability coverage in compliance with Indiana’s requirements. This policy excludes collision or comprehensive coverage, making it more cost-effective for those without a personal vehicle. It ensures you remain insured—and legally compliant—whenever you drive.

Non-Owner SR-22 insurance typically applies to drivers who borrow cars from friends, family, or car-sharing services. Even if you rent a vehicle briefly, you still need to adhere to your SR-22 obligations. By maintaining a Non-Owner policy, you stay covered during these occasional drives without paying for unneeded coverage on a vehicle you don’t own.

Owner (or Owner-Operator) SR-22 Insurance

Drivers with their own vehicles typically file an Owner SR-22 policy. This combines standard auto coverage with an SR-22 certificate. Coverage limits can match or exceed state minimums. By maintaining an Owner SR-22 plan, you protect yourself financially while fulfilling legal obligations.

If you have multiple vehicles, your policy can be structured to cover each one. This ensures you remain compliant no matter which car you drive. Keep in mind that if you transfer ownership or purchase new vehicles, you should update your insurance agent right away.

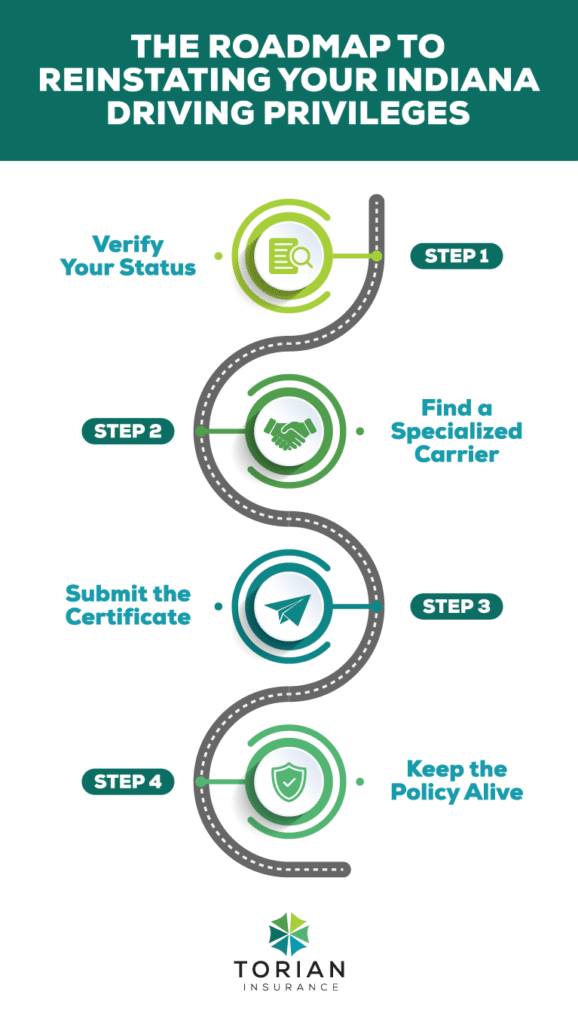

Steps to Obtain SR-22 Insurance in Indiana

Obtaining SR-22 insurance can be simplified by following a clear process:

- Confirm Your Requirement: If you’re unclear about needing SR-22, verify your driving record or contact the BMV. Knowing why you need an SR-22—e.g., DUI or driving uninsured—guides your next steps and sets a clear timeline.

- Choose the Right Insurer: Not every insurer offers SR-22 filing. Select a provider experienced with these forms. You might also compare personal insurance solutions to find coverage tailored to your needs.

- File the SR-22: Your insurer will file the certificate with the state. A small fee often applies. Once processed, your record will reflect valid financial responsibility.

- Maintain Continuous Coverage: Lapses or cancellations can trigger penalties or extended SR-22 periods, so keeping the policy active is key. Ensure you promptly pay premiums and communicate any address or vehicle changes to your agent.

This approach ensures compliance and prevents unexpected license suspensions.

Managing the Costs of SR-22 Insurance in Indiana

While the SR-22 filing fee itself is usually small, the real financial impact comes from higher premiums tied to your driving record. Serious violations often lead to steeper rate increases, but understanding what drives those costs—and how to manage them—can make the process more affordable.

Key Factors That Affect SR-22 Insurance Costs

Several elements influence what you’ll pay for SR-22 insurance in Indiana:

- Driving History: A record with prior violations leads to higher premiums.

- Violation Severity: DUIs and reckless driving typically carry greater cost increases than minor infractions.

- Vehicle Type: High-risk or high-value vehicles can be more expensive to insure.

- Insurance Company: Each insurer assesses risk differently, so rates can vary widely.

Strategies to Manage the Financial Impact

You can’t change a past violation, but you can take steps to control your overall costs:

- Bundle Policies: Combine auto with home, renters, or life insurance to pursue multi-policy discounts.

- Maintain Continuous Coverage: Avoid any lapses or late payments, which can trigger penalties or further rate hikes.

- Shop Smart with an Independent Agency: Work with an independent agent who partners with multiple carriers and can compare options for you.

- Review and Re-Shop Regularly: Periodically check quotes, especially if your driving record has improved since the violation.

- Align Commercial Needs: If you drive specialized or commercial vehicles, explore commercial auto insurance solutions that keep you compliant without overpaying.

These strategies help reduce the financial strain of an SR-22 requirement while ensuring you still meet Indiana’s legal standards. Think of the SR-22 period as a structured opportunity to rebuild your driver profile: by maintaining a safe record and uninterrupted coverage, you demonstrate reliability to insurers—and once the SR-22 term ends, many carriers may re-evaluate your risk more favorably, potentially leading to lower premiums over time.

Tips for Maintaining Low Impact on Your Driving Record

Keeping a clean record is the best way to lessen SR-22 burdens. Useful strategies include:

- Defensive Driving Courses: Taking an Indiana defensive driving course can demonstrate proactive safety and may reduce points on your license.

- Regular Policy Reviews: Frequent check-ins with your insurer help tailor coverage to your changing situation.

- Safe Driving Habits: Steering clear of new violations gradually improves your overall risk profile, which can lead to more favorable rates once the SR-22 requirement ends.

- Seek Out Safe Driving Resources: Following driving tips from National Highway Traffic Safety Administration and other resources can reduce the likelihood of new moving violations and help maintain a positive driver profile.

Additionally, staying aware of your vehicle’s condition—such as maintaining proper tires and brakes—can help prevent avoidable infractions like equipment violations. Small steps, like operating safely in work zones and abiding by school zone rules, further reinforce a positive record.

Consequences of Failing to Maintain SR-22 Compliance

Falling out of compliance with SR-22 obligations may lead to:

- License Suspension: Losing coverage can result in immediate suspension. Reinstatement often requires additional fees and could involve retaking portions of the licensing process.

- Higher Premiums: Each lapse raises your risk profile, potentially increasing insurance costs. Your insurer may classify you in a higher risk bracket for an extended period.

- Legal Penalties: Driving with a suspended license or inadequate coverage can incur fines or criminal charges, adding more complexity to your situation.

Because these penalties can disrupt your daily life, from work commutes to personal errands, it’s crucial to remain diligent about your coverage. Regularly confirming that your insurer has all necessary information—such as a current address—helps avoid accidental lapses.

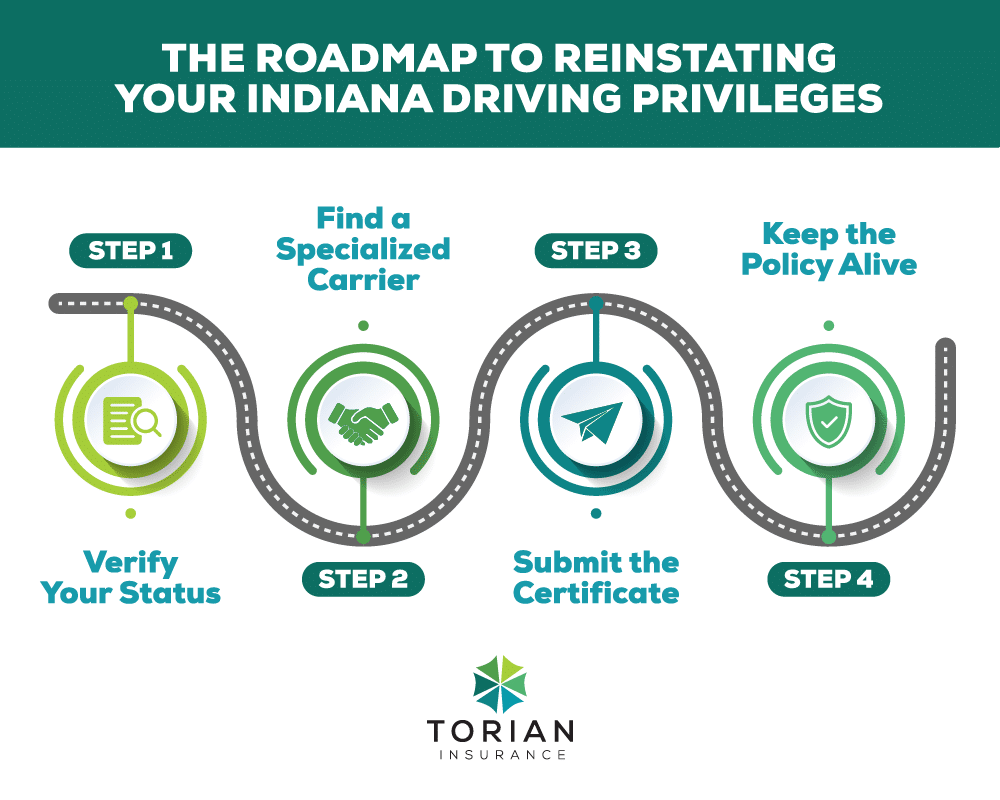

A Roadmap to Reinstating Your License with SR-22

Drivers often view SR-22 as a roadblock, but it can also serve as an opportunity to reset your relationship with driving and insurance. Here’s a brief roadmap:

- Identify the Requirement Early: As soon as a court or the BMV mandates SR-22, start exploring your options. Being proactive prevents last-minute scrambling and possible coverage gaps.

- Gather Your Documentation: Keep your driver’s license details, vehicle registration, and any court documents handy. Providing clear information to your insurer speeds up the filing process.

- Stick to Scheduled Payments: Late payments could lead to coverage cancellation. Ensure you set up alerts or automatic payments if necessary.

- Utilize Support Systems: Family, friends, and community resources can help you navigate limited driving situations while your license is suspended. Focusing on compliance now can lead to a faster reinstatement.

- Stay Updated: Policy changes, new laws, or adjustments to your personal circumstances can affect your SR-22 requirement. Maintain open communication with your agent and check official resources when needed.

Once the requirement is lifted, you’ll typically receive documentation from the BMV. At that point, your SR-22 filing is no longer necessary, and you can revert to more conventional insurance coverage.

Additional Considerations: Navigating Changes in State Laws

State regulations can change over time, so it’s wise to remain informed. Periodically check resources from the Indiana Department of Insurance to stay current on policy updates. By adapting quickly to any legislative changes, you’ll reduce the risk of non-compliance and avoid sudden increases in costs or coverage requirements.

If Indiana adjusts its minimum liability requirements or modifies SR-22 rules, knowing the updates can prevent surprises at renewal time. Stay connected with your independent insurance agent, who can alert you to new guidelines that may affect your policy.

How an Independent Insurance Agent Can Help

Working with an independent insurance agent offers advantages that go beyond simply finding a policy. Independent agents have access to multiple carriers, enabling them to compare a variety of insurance options, discounts, and coverage levels. This flexibility is particularly valuable for individuals required to file SR-22, as pricing and underwriting decisions can differ significantly between insurers.

In addition to filing the SR-22 paperwork on your behalf, an independent agent:

- Assists with any policy adjustments that arise from life changes or updated legal requirements.

- Provides guidance on maintaining continuous coverage, minimizing the risk of a mismatch in your SR-22 status.

- Helps integrate any additional insurance needs, whether business or personal, into a balanced coverage strategy.

By partnering with a local, community-focused agency like Torian Insurance, you gain a resource committed to understanding your situation. You also benefit from a more personalized experience, as larger firms may not invest the same time in individualized service.

FAQs About SR-22 Insurance in Indiana

What Differentiates Standard Auto Insurance from SR-22 Insurance?

Standard auto insurance meets legal coverage requirements. An SR-22 is an additional certification your insurer files to confirm you hold that required coverage. It does not replace your standard policy.

How Long Must I Maintain SR-22 Insurance?

Most drivers keep SR-22 insurance for two to three years. Confirm the exact timeline with the BMV or your insurer, since requirements vary based on the nature of the violation. Any new violations may prolong the term.

Can I Switch Insurance Providers During My SR-22 Requirement?

Yes. However, your new insurer must file an SR-22 before you cancel your current plan to avoid any coverage gap that might reset your penalty period. Staying consistent prevents suspensions and maintains your progress toward completing the SR-22 mandate.

What Should I Do If I Notice Errors on My Driver Record?

Contact the BMV immediately to correct discrepancies, and update your insurance agent. Prompt attention helps avoid further complications or extended SR-22 obligations. Keep records of any correspondence, just in case you need confirmation later.

Regaining Confidence with SR-22 Compliance and Expert Guidance

SR-22 insurance in Indiana is a vital tool for demonstrating financial responsibility after serious infractions. Although the process can seem daunting, understanding the requirements and maintaining continuous coverage are essential steps in regaining your driving privileges. A trusted independent agency can simplify compliance and connect you with cost-effective options.

Since 1923, Torian Insurance has served Southern Indiana with personalized, community-focused service. Whether you need help filing SR-22 or want to explore broader auto insurance solutions, contact our dedicated team for a customized consultation. Regain confidence on the road with knowledgeable guidance, flexible coverage, and unwavering local support.