Navigating the world of renters insurance can often seem like a complex task, filled with industry jargon that’s difficult to decipher.

As a renter or prospective renter in the tri-state area of Indiana, Illinois, and Kentucky, you may find yourself asking, “What is renters insurance, do I really need it, and what does it cover?” This blog post aims to demystify these questions and guide you in understanding the importance of renters insurance.

Read on to become a more informed and confident renter, equipped with the knowledge to select the right insurance policy for your needs.

Understanding Renters Insurance

Renters insurance, often overlooked, is an essential form of protection for tenants. It’s a type of insurance policy that safeguards renters against unexpected circumstances such as theft, fire, or certain types of water damage.

When unforeseen incidents occur, renters insurance can provide coverage for your personal belongings and temporary living expenses, as well as liability protection.

The need for renters insurance is not limited to any particular type of renter. Whether you’re a college student living in a dorm, a family renting a house, or a senior citizen in an apartment, renters insurance is a wise investment. It offers a financial safety net in the event of loss or damage to your personal property, and it can also provide coverage for injury to others on your premises.

What Renters Insurance Covers

Renters insurance provides a safety net for your personal belongings. If your belongings are damaged, stolen, or destroyed, a typical renters insurance policy can help cover the costs to repair or replace them.

This coverage extends to a wide array of personal items, from furniture and electronics to clothing and kitchen appliances.

However, renters insurance doesn’t stop at protecting your personal property. It also includes liability coverage. This feature safeguards you in case someone is injured on your property, or if you accidentally cause damage to others’ property. It can cover legal fees and potential settlement costs, offering an essential layer of financial protection.

The Difference Between Renters and Homeowners Insurance

The personal liability coverage offered between renters and homeowners insurance is very similar. A homeowner may need to purchase higher limits because of the great responsibility, but the terms of coverage are almost identical. However, there are some distinct differences between renters insurance and homeowners insurance that are crucial to understand, as they cater to different needs.

Renters insurance primarily focuses on the renter’s personal belongings within the rented property. It does not cover the physical structure of the property itself. This is a significant deviation from homeowners insurance, which covers both the house’s structure and the owner’s personal belongings inside.

Furthermore, it’s important to note that the landlord’s homeowners insurance only covers the building structure and not the tenant’s personal belongings. Therefore, relying on your landlord’s homeowners policy as a renter can leave you vulnerable to significant financial loss.

Although renters insurance is typically more limited in coverage than homeowners’ policies, it can still provide essential financial protection for tenants.

The Cost of Renters Insurance

Renters insurance is often misunderstood, leading to the spread of myths that can misguide renters.

One of the biggest myths about renters insurance is that it is expensive.

The cost of renters insurance is typically quite affordable, with average rates often much lower than most people expect. It’s a small price to pay for the peace of mind it offers.

The Importance of Liability Coverage in Renters Insurance

Liability coverage is a critical component of a renter’s insurance policy. It protects you from the financial implications of unintentional damage to someone else’s property or if someone is injured in your rented residence. It essentially covers legal costs and compensations should you be found legally responsible for these incidents.

For example, if a guest trips over a loose carpet in your rental unit and sustains an injury, you could be held liable for their medical expenses.

Similarly, if you accidentally cause damage to your neighbor’s property, say, due to a fire that started in your unit, the liability coverage can assist in covering the repair costs. These instances underscore the significance of having liability coverage in your renter’s insurance.

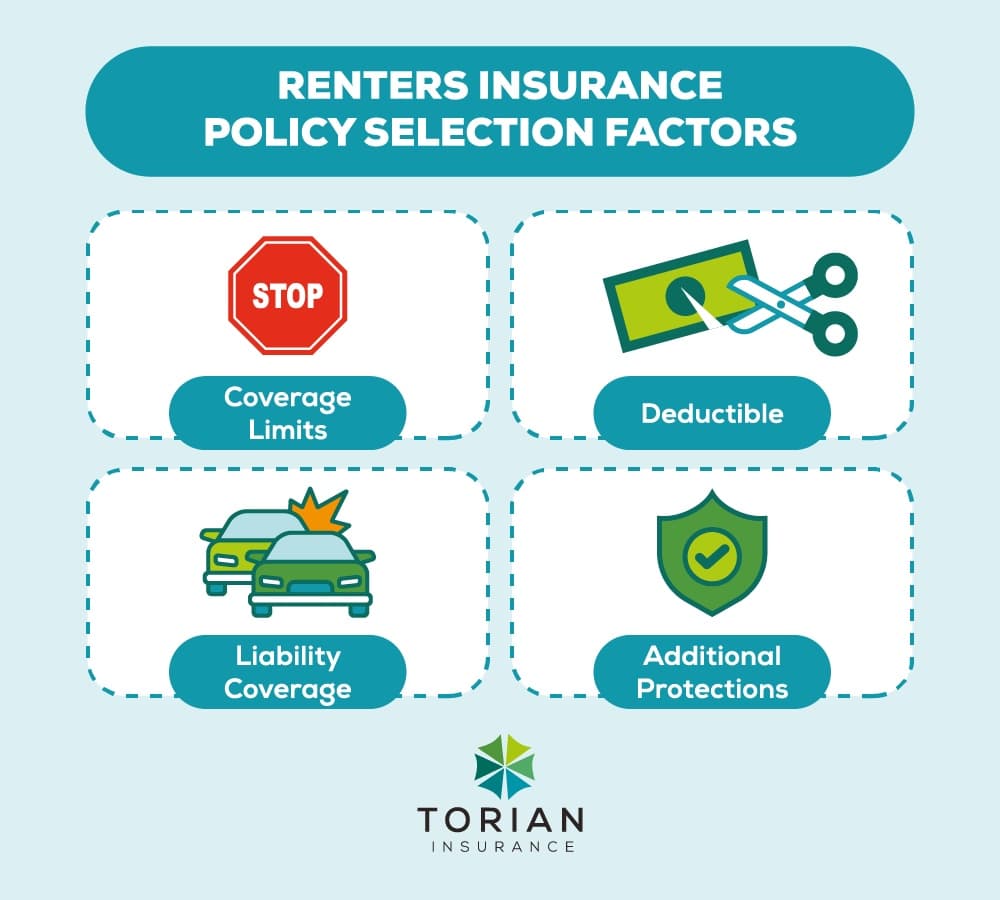

Choosing the Right Renters Insurance Policy—4 Factors

Choosing a renters insurance policy can feel like navigating a maze. There are many factors to consider to ensure you’re properly covered and getting the best value for your money.

Primarily, it’s essential to evaluate the policy’s coverage limits. These limits should adequately reflect the value of your possessions, so you’re not left underinsured in case of a loss.

Next, consider the car insurance deductible. This is the amount you’ll have to pay out-of-pocket before your insurance kicks in to cover a loss. A lower deductible generally means higher premiums and vice versa. However, don’t be enticed by lower premiums alone; pay attention to what you can afford to pay out-of-pocket in case of damage or theft.

Your policy’s liability coverage is another crucial factor to consider. Most renters insurance policies offer liability coverage, but the amount can vary substantially. This coverage protects you if you’re held legally responsible for injury to others or damage to their property.

Finally, consider any additional protections you may need. For instance, if you live in a flood-prone area, you may want to purchase additional flood insurance since renters insurance typically doesn’t cover flood damage.

Considering Torian Insurance for Renter's Insurance Needs

Torian Insurance, with its years of industry expertise, has established itself as a trusted provider of renters insurance.

We understand the unique challenges and needs of renters and our team of dedicated insurance professionals is committed to guiding you through the process of finding a policy that fits your needs.

We take pride in our personalized approach. Instead of offering a one-size-fits-all policy, we take time to understand your circumstances and tailor a policy accordingly. Whether you’re renting a small studio apartment or a spacious family home, we’ve got you covered.

Moreover, our comprehensive renters insurance policies not only protect your personal belongings but also include liability coverage. This can provide peace of mind knowing that you are protected if someone is injured at your residence, or if you accidentally cause damage to the property.

Renters Insurance—A Practical Investment for the Responsible Renter

Understanding the nuances of renters insurance, including its importance and the liability coverage it provides, is crucial for all renters. This understanding allows you to make informed decisions about protecting your belongings and your liability against potential damages.

Choosing the right policy, however, can be a complex process. This is where an expert like Torian Insurance can help. Our knowledgeable insurance professionals take a personalized approach, tailoring the policy to your needs.

Remember, being a covered renter not only safeguards your possessions but also provides peace of mind. Trust Torian Insurance to guide you through this important decision.