Hosting an event where alcohol is served can elevate the occasion, adding a celebratory flair to weddings, reunions, corporate functions, and fundraisers. However, serving alcohol also comes with significant responsibilities that extend beyond picking a drinks menu. Whether you provide alcohol directly or allow guests to bring their own, you face potential legal and financial liability if alcohol consumption leads to an accident or other harm. Obtaining dedicated liquor liability insurance is an essential safeguard, protecting you from unforeseen legal and monetary burdens.

In this article, we discuss the critical elements of liquor liability insurance, potential legal risks, and practical tips for responsible alcohol service. By understanding these factors, event hosts can minimize liabilities and keep gatherings safe.

Why You Need Liquor Liability Insurance (Even for Small Events)

Serving alcohol changes the risk profile of any gathering—whether it’s a backyard celebration, a wedding reception, or a company party. Many hosts assume their homeowner’s policy, general event insurance, or a venue’s coverage will protect them if something goes wrong. In reality, alcohol-related incidents are often excluded or narrowly covered, which is why liquor liability insurance is worth considering even for smaller events.

- General liability, event insurance, and homeowners policies often exclude alcohol-related claims. If an incident involves an intoxicated guest, you may discover too late that your existing coverage has an alcohol exclusion or only very limited protection.

- One accident can trigger expensive lawsuits—regardless of event size. A single over-served guest, altercation, or injury can lead to legal defense costs, settlements, and medical-related claims that quickly outpace what most hosts expect.

- BYOB can still create real exposure for hosts and organizers. Even when you aren’t “selling” alcohol, guests can overindulge or share drinks with minors, and you could still face allegations that you failed to supervise or maintain a safe environment.

- Venues, municipalities, and vendors may require proof of liquor liability coverage. Many event spaces and public permits require a Certificate of Insurance (COI), and some contracts require the venue or vendor to be listed as an Additional Insured.

- Alcohol increases the odds of common event claims. Intoxication can contribute to slips and falls, property damage, fights, or impaired driving—creating a wider range of scenarios where your event could become the focal point of a claim.

- Liquor liability insurance protects your finances and lets you host with confidence. With the right policy in place, you’re better prepared for legal costs and covered damages so one unexpected incident doesn’t derail your personal or business finances.

Understanding Liquor Liability and BYO Alcohol at Events

Liquor liability refers to the legal responsibility assumed when alcohol is served or consumed at an event. In many states, laws focus on preventing the service of alcohol to minors and ensuring that responsible protocols are followed. While some jurisdictions may not hold social hosts liable for injuries caused by intoxicated adult guests, others do—particularly if there is clear evidence of reckless service or providing alcohol to visibly intoxicated individuals.

When events feature a “bring your own” (BYO) policy, the situation can become more complicated. Without professional oversight, guests could overindulge or share alcohol with minors, creating significant liabilities for the host. Common BYO scenarios include:

- Weddings where cost-saving measures prompt guests to bring their own beverages.

- Large family gatherings where supervision may be casual or inconsistent.

- Corporate celebrations where it is mistakenly assumed that adult attendees will manage themselves responsibly.

In all these cases, comprehensive insurance coverage serves as a protective measure against potential legal and financial fallout.

“Host Liquor Liability” vs. “Liquor Liability”: What’s the Difference?

These terms are often used interchangeably, but they can point to different event setups.

- Host Liquor Liability: Typically refers to alcohol-related liability for private events where alcohol isn’t being sold—for example, weddings, graduation parties, reunions, or company celebrations where drinks are provided for free (or the event is BYOB). Many standard policies still exclude alcohol-related incidents, so you may need a special event policy that includes host liquor liability.

- Liquor Liability: Often used for events with a higher exposure, especially when alcohol is sold (cash bar, drink tickets, fundraising sales) or when a venue/permit specifically requires “liquor liability” on the insurance paperwork. The exact label matters less than making sure the policy matches how alcohol will be served and what the venue contract requires.

If you’re unsure which applies, the key questions are: Is alcohol being sold? Who is serving it? And what does the venue/permit require on the Certificate of Insurance?

Certificate of Insurance (COI) and Additional Insured: What Venues Often Require

Many venues, municipalities, and vendors require proof of coverage before they’ll finalize your booking—especially if alcohol will be present. That proof usually comes in two parts:

- Certificate of Insurance (COI): A one-page document showing you have active coverage for the event. It typically lists the policy type(s), limits, date(s), and the insurer. It’s the standard “proof of insurance” most venues ask for.

- Additional Insured: Means the venue (and sometimes a municipality or vendor) is added to your policy for certain claims arising out of your event. In plain language, it helps protect them if they’re brought into a lawsuit connected to what happened at your gathering.

Before you buy coverage, check your venue contract for insurance requirements (limits, exact name/address to list, Additional Insured wording, and deadlines) so your COI matches what the venue is asking for.

What Liquor Liability Insurance Typically Covers (and What It Often Doesn’t)

Typically covers (depending on the policy and circumstances)

- Bodily injury claims tied to alcohol-related incidents (for example, a guest injures another person after becoming intoxicated)

- Property damage caused during an alcohol-related incident (damage to the venue or someone else’s property)

- Legal defense costs (attorney fees, court costs, investigation expenses)

- Settlements or judgments if you’re found legally responsible, up to the policy limits

- Medical-related costs associated with covered injury claims (varies by carrier/policy wording)

Often does NOT cover (common exclusions/limitations—policy language varies):

- Intentional or expected harm (assault, fighting you initiate, deliberate property damage)

- Criminal acts or illegal conduct connected to the event

- Serving alcohol to minors or failing to follow required ID-verification procedures (often excluded and can create serious legal exposure)

- Assault and battery claims unless an endorsement is added (many policies exclude this or restrict it)

- Auto accidents under your own auto policy (a guest’s crash is typically handled through auto insurance; liquor liability may respond to allegations against the host, but it won’t replace auto coverage)

- Employee/worker injuries (generally handled by workers’ compensation, not liquor liability)

- Damages above your policy limits (you’re responsible for amounts beyond the coverage limits)

- Contractual liabilities you assume beyond what the policy covers (for example, broad indemnity language in venue contracts)

Tip: If your venue requires a Certificate of Insurance (COI) or Additional Insured wording, review those requirements early—some exclusions (like assault and battery) can matter a lot depending on the venue and event type.

Risks and Legal Implications of Alcohol at Events

Serving alcohol entails several key risks, including:

- Property damage from guests who may accidentally break items or harm the venue.

- Personal injuries resulting from falls, altercations, or other mishaps.

- Drunk driving accidents where liability could extend beyond the event. According to the National Highway Traffic Safety Administration (NHTSA), nearly 32 people in the United States die in drunk-driving crashes every day, highlighting the pressing nature of this public safety problem.

- Legal repercussions if minors obtain alcohol at your gathering.

Because social host liability laws vary significantly, understanding local legal requirements is vital. Some states impose no liability for injuries caused by an adult’s intoxication, while others hold the host accountable in certain scenarios. Awareness of these distinctions—along with the universal prohibition against serving alcohol to minors—helps event organizers evaluate financial risk more accurately.

Furthermore, hosts may face claims from third parties if an intoxicated guest harms someone else after leaving the event. According to guidelines on dealing with intoxicated guests, even one misjudgment can lead to costly consequences.

Legal Considerations and Regulatory Environment

Navigating the legal environment surrounding alcohol service demands thorough research. Some states impose “dram shop” laws that extend liability to anyone who provides alcohol to a clearly intoxicated person. Others have more lenient positions on social host liability for adult guests but carry severe penalties for any event involving underage drinking.

Moreover, local ordinances sometimes require permits for serving alcohol at public gatherings or fundraisers. Though these permits may appear routine, ignoring them can lead to fines or revoked permissions to host future events. In short, event organizers should take time to review all relevant legal obligations before serving alcohol—especially if the gathering is held at a rented venue, in a public space, or as a large-scale community event.

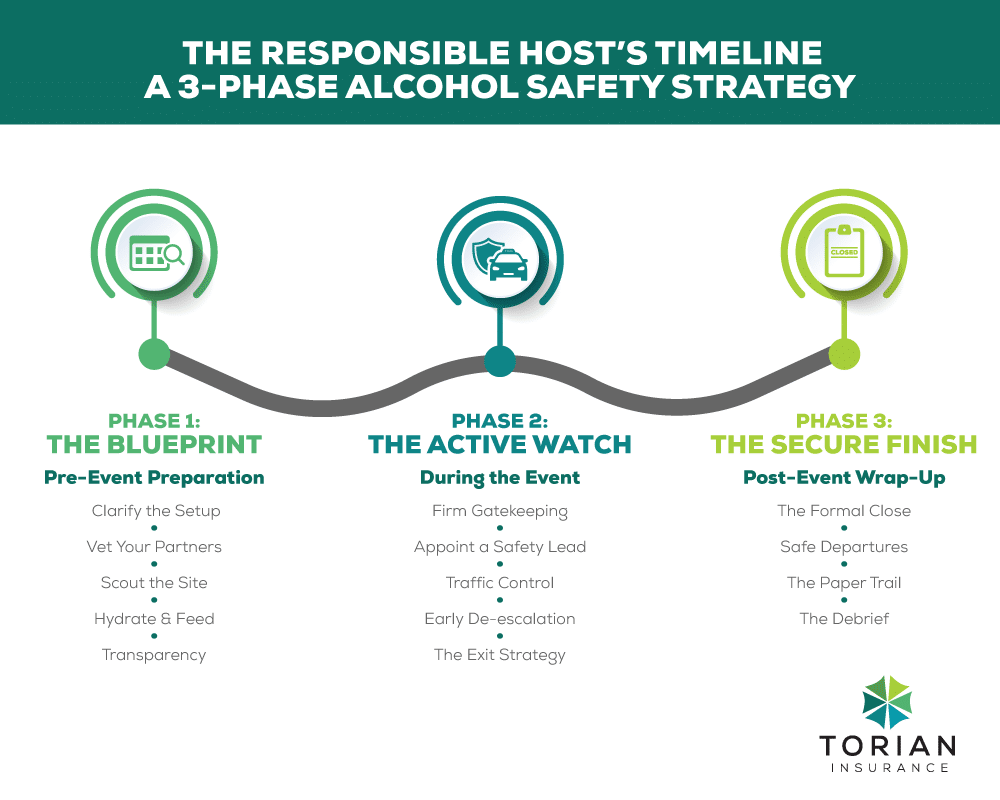

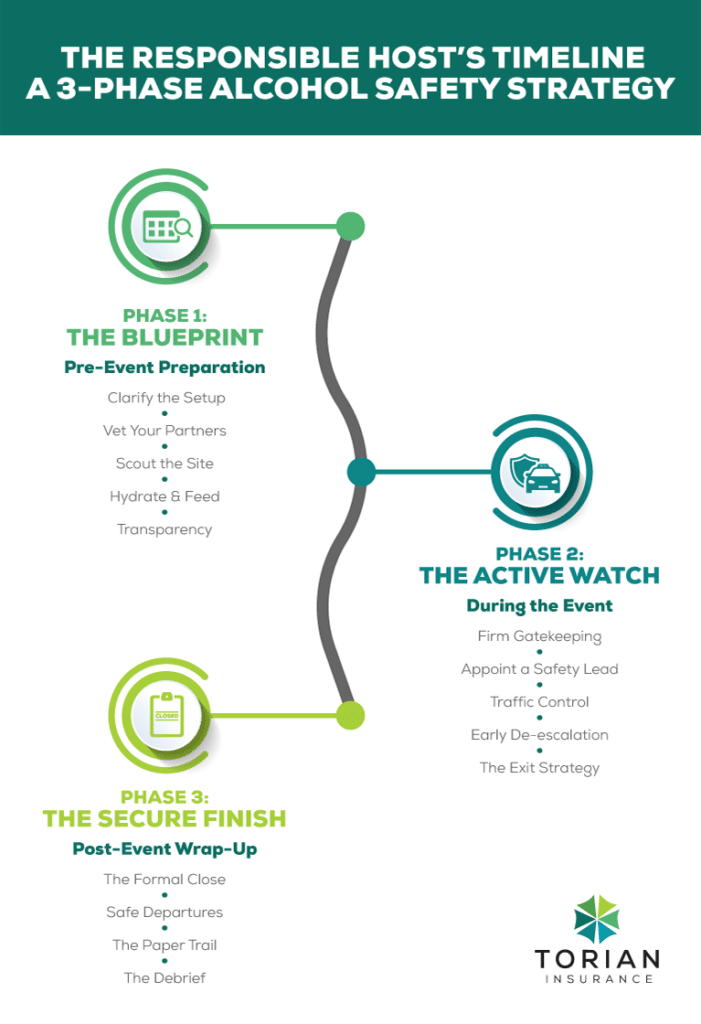

Event Host Safety Checklist (Before / During / After)

Liquor liability insurance is an important backstop, but prevention still matters. Simple steps—like using trained bartenders, planning your venue layout, communicating expectations, and offering safe ride options—can reduce the chance of an incident in the first place. Use the checklist below to build a practical plan for before, during, and after your event.

Before the Event

- Confirm who is providing alcohol (host, BYOB, caterer) and clarify who is responsible for service and oversight. If using a venue or vendor, ask what coverage they carry and what they require from you (such as a Certificate of Insurance and Additional Insured wording).

- Hire professional bartenders or a licensed alcohol service provider when possible. Trained servers are more likely to check IDs, spot intoxication early, and follow responsible service practices.

- Plan the environment for safety. Walk the venue to identify trip hazards, poorly lit areas, crowd bottlenecks, and emergency exit access; then adjust layout, add signage, and secure cords/rugs/decor.

- Reduce overconsumption by design. Provide plenty of food and water, offer appealing non-alcoholic options, and consider limiting high-alcohol selections or setting a defined last-call time.

- Set expectations with guests in advance. Include a short alcohol policy on invitations, tickets, or registration (ID checks, no service to minors, and the host’s right to stop service).

During the Event

- Enforce ID checks and monitor service consistently. Make it clear that servers can refuse service and should not serve anyone who appears visibly intoxicated.

- Assign a point person for issues. Designate someone to handle vendor coordination, guest safety concerns, and incident documentation so staff aren’t guessing in the moment.

- Keep the space controlled and observable. Monitor high-traffic areas, keep pathways and exits clear, and use signage or barriers where crowding or confusion is likely.

- Watch for early warning signs. Address escalating situations quickly—over-intoxication, arguments, unsafe behavior—before they turn into injuries, property damage, or police involvement.

- Offer safe transportation options. Promote rideshare, taxis, a shuttle, or designated drivers, and intervene if someone appears unfit to drive.

After the Event

- Close alcohol service deliberately. Shut down service at the planned time, remove access to remaining alcohol, and ensure staff know the procedure for guests who want “one more.”

- Help guests leave safely. Make transportation options easy to access and encourage impaired guests to use them.

- Document any incidents promptly. Write down what happened, who was involved, and what actions were taken (and keep any vendor/security reports), in case a claim arises later.

- Do a quick post-event review. Note what went well and what should change next time (staffing levels, layout, signage, bar setup, or communication) so future events are safer and smoother.

The Value of Customized Liquor Liability Solutions from Independent Insurance Agents

When seeking liquor liability insurance, working with independent insurance agents can make a significant difference. Unlike agents bound to a single carrier, independent agents compare multiple offerings to find the most suitable policy for your event’s parameters. Factors such as the type of event, the number of attendees, whether alcohol is sold or given away, and the venue’s location are all considered.

At Torian Insurance, we bring over a century of expertise in providing personalized coverage to our local communities in Southern Indiana, Illinois, and Kentucky. We evaluate your event thoroughly and propose a policy package that protects against legal liabilities while meeting any unique needs—like high-value venues or extended event durations. Our local ownership and community focus enable us to understand region-specific legal and cultural nuances, ensuring that you get precisely the right coverage.

Additionally, working with an independent insurance agent can streamline the entire process. From initial consultation to adjusting coverage if your event plans change, an independent agent acts as your advocate every step of the way.

Embrace Safety and Celebration with Smart Event Hosting

Serving alcohol at an event can be a lot of fun—but it also comes with real liability. With the right liquor liability coverage and a few smart hosting practices, you can protect yourself financially and create a safer experience for your guests.

For tailored guidance and community-focused service, turn to the team of specialists Torian Insurance to secure the right coverage for your special event. Our extensive experience in offering customized solutions can keep your gathering both enjoyable and shielded from unnecessary liability. Contact us today to learn how we can help you host a safe, successful event.