Understanding the home insurance terms that determine your claim payout can help you make more confident decisions about your homeowners coverage. Two of the most important concepts are Actual Cash Value vs Replacement Cost—and the difference between them can affect not only how much you’re paid after a loss, but also when you’re paid.

In this guide, we break down ACV and RC in clear language, explain the often-missed detail of how replacement cost claims are commonly paid (ACV first, then recoverable depreciation), and highlight key factors—like roof settlement terms, local rebuild costs, and building-code upgrades—that can change what you receive. You’ll also find a quick decision checklist to help you choose the approach that best fits your home and budget.

What Is Actual Cash Value (ACV)?

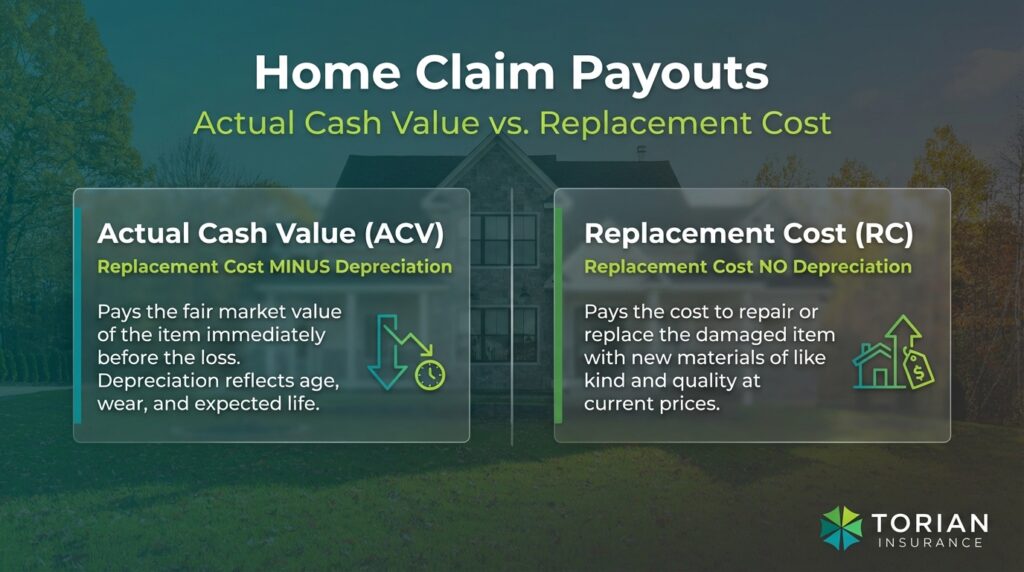

Actual Cash Value (ACV) is what the damaged property is worth right before the loss, not what it costs to buy new today. Insurers typically calculate ACV as replacement cost minus depreciation, where depreciation reflects age, condition, and expected useful life (and sometimes market factors, depending on the policy and state rules).

What This Looks Like In Real Life

- ACV is common for items that naturally wear out (roofing, flooring, appliances).

- If the item is older, the depreciation can be significant—so the claim payment may cover only a portion of the cost to replace with new materials.

- ACV is a settlement method (how the claim is paid). It can apply to different parts of your policy differently (for example, the roof might be ACV even if other parts are replacement cost).

- The exact depreciation method and documentation requirements can vary by carrier and policy form.

What Is Replacement Cost (RC)?

Replacement Cost (RC) coverage is designed to pay the cost to repair or replace damaged property using materials of like kind and quality at today’s prices—without subtracting depreciation. You’ll still be responsible for your deductible, and the payout is subject to your policy’s limits and conditions.

Like Kind And Quality (LKQ), In Plain Terms

This means replacing what you had with something comparable, not upgraded. For example, if your home had laminate countertops, RC generally pays to replace them with similar laminate—not automatically with stone.

Two Common Reasons RC May Not Cover The Full Rebuild Total

- Coverage limits: RC can’t pay more than the dwelling limit (and other applicable limits) shown on your policy—even if today’s rebuild cost is higher.

- Coverage gaps requiring endorsements: Certain extra costs—like rebuilding to updated building codes—often require add-ons such as Ordinance or Law coverage.

How RC Claims Are Actually Paid

Even when you have Replacement Cost coverage, many insurers don’t issue one “full replacement cost” check upfront. Instead, RC claims often settle in two steps:

- Initial payment (ACV payment): The insurer pays the Actual Cash Value first (replacement cost minus depreciation), then subtracts your deductible. This is the amount you can typically use to start work.

- Final payment (recoverable depreciation / “holdback”): After repairs are completed and you provide documentation (commonly invoices, receipts, photos, or a contractor’s final bill), the insurer pays the recoverable depreciation that was withheld—up to your policy limits and subject to policy deadlines/conditions.

Why This Matters

- You may need a plan to bridge the gap between the first check and the final reimbursement—especially for large losses like roofing.

- Your contractor may be able to structure payment milestones around the insurer’s payment schedule (this can reduce cash-flow stress).

- If repairs aren’t completed (or aren’t completed within the policy’s requirements), you may not receive the recoverable depreciation portion.

Choosing Between Actual Cash Value vs Replacement Cost: A Quick Checklist

Choosing between Actual Cash Value (ACV) and Replacement Cost (RC) usually comes down to one thing: how much cost uncertainty you’re willing to absorb after a claim. Use the checklist below to match each option to your priorities.

ACV May Make Sense If You

- Prefer premium stability and can accept more variable claim outcomes

- Have cash reserves (or access to financing) to cover depreciation gaps after a loss

- Are insuring a home where you’d likely do partial repairs or phase repairs over time

- Have older components (roof, HVAC, finishes) and you’re comfortable replacing “as needed” rather than restoring everything to like-new

RC May Make Sense If You

- Want repairs to be guided by today’s prices, not an item’s age

- Don’t want to negotiate big scope/cost decisions around depreciation after a loss

- Own a home with newer finishes, recent renovations, or higher-cost materials

- Want a claims process that more closely aligns with contractor estimates (while still following policy terms)

Additional Consideration For Decision Tie Breaker

- If you’re choosing between the two, compare the annual premium difference to the potential depreciation exposure on your biggest-ticket items (roof, siding, flooring, cabinets).

Factors That Change The Decision: And What To Check

These are the “small print” items that often decide whether RC is worth it (or whether you truly have it).

- Roof terms: Some policies settle roofs at ACV after a certain age, apply a roof payment schedule, or restrict certain types of damage (like cosmetic-only hail damage). What to check:

- Is your roof ACV or RC?

- Is there a separate wind/hail deductible?

- Any roof-specific endorsement that changes settlement (schedule, age threshold, cosmetic limitation)?

- Home age and condition: Older homes can have more expensive rebuild considerations (matching materials, outdated systems, harder-to-source finishes). What to check:

- Is your Coverage A (Dwelling) limit based on true replacement cost—not purchase price or market value?

- Do you have options like extended replacement cost (if offered) to help when rebuild costs spike?

- Claims history: Prior claims can change what carriers will offer and at what cost—sometimes affecting whether RC (or RC for roofs) is available or affordable. What to check:

- Would adjusting the deductible meaningfully reduce premium while keeping RC?

- Are there endorsements that change roof settlement or personal property settlement?

- Local rebuild costs: After widespread storm events, labor/material availability can tighten and pricing can rise quickly. What to check:

- Do you have inflation guard (auto-adjusting limits)?

- Any form of extended replacement cost available?

- Are you reviewing rebuild cost periodically (especially after renovations)?

- Code upgrades: Rebuilding may require upgrades to meet current building codes (electrical, roofing standards, safety requirements). What to check:

- Do you carry Ordinance or Law coverage, and is the limit high enough for a meaningful code-upgrade scenario?

Benefits Of Working With An Independent Insurance Agency

Navigating the differences between ACV and RC for home insurance can be challenging. At Torian Insurance, our experienced independent agents offer guidance tailored to your unique circumstances. We take the time to understand your home’s condition, local risks, and financial needs. Based on this information, we recommend the coverage that best secures your investment.

Because we can compare policies from multiple carriers, we provide custom insurance solutions that offer optimum protection at a balanced price. From policy selection to helping you handle claims, our dedicated team ensures you’re never alone in the process.

FAQs

Is replacement cost always better than actual cash value?

Not always. Replacement cost typically offers a more complete settlement, but ACV can be a reasonable choice if keeping premiums low is your priority and you could cover depreciation-related gaps after a claim without hardship.

Do I get replacement cost right away?

Often, no. Many replacement cost claims are paid in stages: the insurer issues an initial ACV payment, then releases the remaining amount (recoverable depreciation) after repairs are completed and documentation is provided, subject to policy conditions.

Why was my claim check lower than expected?

The most common reasons are depreciation (ACV settlement), your deductible, a coverage limit that caps payment, or policy restrictions that apply to specific items (commonly roofs). Your estimate may also include upgrades or non-covered work.

What is recoverable depreciation?

Recoverable depreciation is the portion of the claim value the insurer temporarily withholds. If your policy provides replacement cost coverage and you complete the repairs per policy requirements, that withheld amount may be reimbursed after you submit proof of completed work.

Does replacement cost guarantee my whole home will be rebuilt no matter what?

No. Replacement cost coverage still depends on your policy limits and the scope of what your policy covers. Costs tied to code compliance, specialty materials, or certain rebuild conditions may require endorsements such as Ordinance or Law or extended replacement cost options.

Is my roof covered differently than the rest of my home?

Sometimes. Roofs are frequently subject to different settlement terms (ACV vs RC), separate wind/hail deductibles, or endorsements tied to roof age and material type. It’s worth confirming roof settlement terms specifically—before storm season.

What happens if I don’t repair the damage?

If you don’t complete repairs, many policies won’t pay the recoverable depreciation portion of a replacement cost claim. You may end up with only the ACV amount (minus deductible), even if your policy includes replacement cost coverage.

Know What Your Policy Will Pay—Before You Need It

Actual Cash Value and Replacement Cost may sound like minor policy details, but they can change your financial picture after a claim. ACV settlements factor in depreciation, which can reduce the initial payout and leave you covering more of the gap to replace items with new materials. Replacement Cost coverage is designed to reimburse repairs or replacement at today’s prices, but it still operates within your policy limits and often pays in stages—meaning you may receive an ACV payment first and recover the withheld depreciation only after repairs are completed and documented.

Don’t wait until a claim to find out what your policy really pays. Contact Torian Insurance today for a homeowners coverage review to verify your ACV vs. RC terms, roof settlement details, and whether your limits still match today’s rebuild costs.